Rising inflation in March didn’t deter consumers, who continued shopping at a more rapid pace than anticipated, the Commerce Department reported Monday. Retail sales increased 0.7% for the month, considerably faster than the Dow Jones consensus forecast for a 0.3% rise though below the upwardly revised 0.9% in February, according to Census Bureau data that is adjusted for seasonality but not for inflation. The consumer price index increased 0.4% in March, the Labor Department reported last week in data that also was higher than the Wall Street outlook. That means consumers more than kept up with the pace of inflation,...

Cuban spy Manuel Rocha plea deal raises fresh questions for claims holders

The Miami Herald profiled former Ambassador V. Manuel Rocha in 2003 when he joined the firm of Steel Hector & Davis to help open doors in Latin America. Raul Rubiera | Miami Herald | Getty Images When Carolyn Lamb saw news of Cuban spy Victor Manuel Rocha’s arrest on the news last December, she recognized him immediately. It was the same man who had sat in her Omaha living room 17 years ago, trying to make a deal. On Friday, Rocha, 73, was sentenced to 15 years in prison for acting as a foreign agent on behalf of the Cuban...

Situation in east Ukraine has ‘significantly worsened’: army commander

Colonel General Oleksandr Syrskyi, commander-in-chief of Ukraine’s armed forces. Valentyn Ogirenko | Reuters Ukraine’s top military general warned Saturday that the battlefield situation in the east of the country, which continues to be the epicenter of the fiercest fighting in Ukraine, has deteriorated sharply. “The situation on the eastern front has significantly worsened in recent days,” Oleksandr Syrskyi, commander-in-chief of Ukraine’s armed forces, said on Telegram. “This is primarily due to the significant intensification of enemy offensive actions following the presidential elections in the Russian Federation,” he added, in comments translated by NBC News. Syrskyi said warm, dry weather had...

Italy launched a new digital nomad visa: How to apply

If you’re a digital nomad or a remote worker looking for your next home away from home, consider Italy. The country’s new digital nomad visa went into effect his month, according to Euronews. Italy’s government defines digital nomads as a citizen of non-EU states who carry out “a highly qualified work activity with the use of technological tools capable of allowing them to work remotely,” Euronews states. The worker should either be self-employed, in collaboration with, or as an employee of a company. The visa is good for one year and can be renewed Armando Oliveira | Istock | Getty...

Why car insurance costs are skyrocketing, leading to higher inflation

RobertCrum | Getty Images DETROIT – Skyrocketing auto insurance costs helped contribute to inflation accelerating at a faster-than-expected pace in March and are adding to the ever more expensive costs for U.S. vehicle owners. On a monthly basis, car insurance prices as part of the consumer price index rose by an unadjusted 2.7%, while the year-over-year increased by 22.2%, according to data released Wednesday. The index is a key inflation gauge and a broad measure of the cost of goods and services across the economy. Auto insurance costs have been on the rise for some time, growing every month as...

Consumer prices rose 3.5% from a year ago in March

The consumer price index accelerated at a faster-than-expected pace in March, pushing inflation higher and likely dashing hopes that the Federal Reserve will be able to cut interest rates anytime soon. The CPI, a broad measure of goods and services costs across the economy, rose 0.4% for the month, putting the 12-month inflation rate at 3.5%, or 0.3 percentage point higher than in February, the Labor Department’s Bureau of Labor Statistics reported Wednesday. Economists surveyed by Dow Jones had been looking for a 0.3% gain and a 3.4% year-over-year level. Excluding volatile food and energy components, the core CPI also...

SEC won’t approve ether (ETH) exchange-traded fund

Jakub Porzycki | Nurphoto | Getty Images PARIS — Issuers of spot bitcoin exchange-traded funds on Tuesday say the U.S. Securities and Exchange Commission is unlikely to approve such a product for the cryptocurrency ether. The regulator has a late May deadline to conclude its review on an ether ETF. That comes after the SEC in March delayed its original deadline for a decision on the ether ETF application. Companies ranging from BlackRock to Fidelity and VanEck, which issued spot bitcoin ETFs this year, have been waiting for approval of an ether product. Some issuers are not confident the SEC will greenlight...

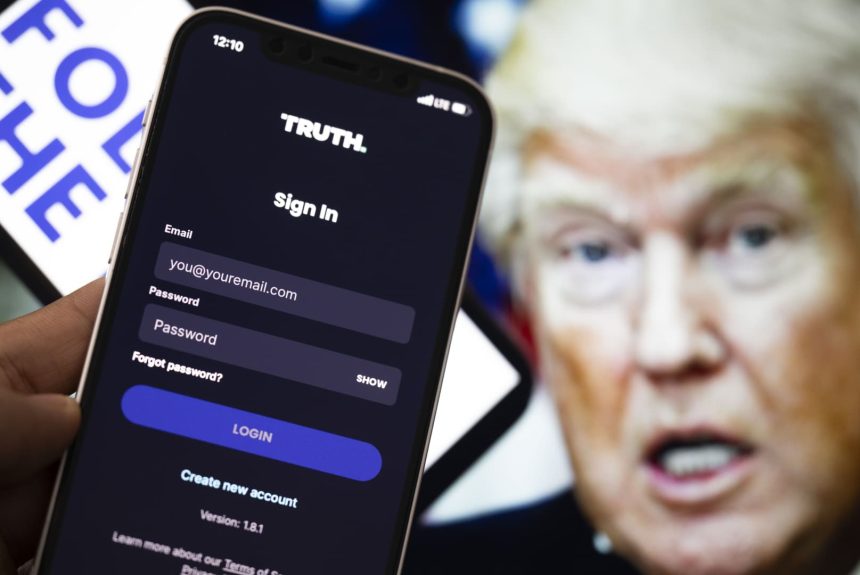

Trump Media stock drops more than 10% to open trading week

Aytac Unal/ | Anadolu | Getty Images Trump Media shares dropped more than 10% in early trading Monday, putting its market capitalization to just below $5 billion. DJT‘s plunge followed a 12% decline in its share price on Friday. Trump Media, which owns the Truth Social app used by its biggest shareholder, former President Donald Trump, had a high price of nearly $80 two weeks ago after it began trading as a publicly held company. Its share price as of 2:36 p.m. ET Monday was $36.24 per share, a 10.72 decrease for the day. Trump Media’s market cap stood at...

Boeing engine part fell off during Southwest flight takeoff: FAA

A Southwest Airlines Boeing 737 MAX 8 arrives at Daniel K. Inouye International Airport on January 20, 2024 in Honolulu, Hawaii. Kevin Carter | Getty Images A Southwest Airlines flight returned to Denver International Airport Sunday morning after a Boeing engine cowling fell off the plane and struck a wing flap during takeoff, the Federal Aviation Administration said. The Boeing 737-800 plane was on its way to Houston’s William P. Hobby Airport. Southwest said customers on the flight transferred to a different aircraft and were scheduled to arrive at their destination three hours late. In response to a request for...

Best advice on buying a $1 home in Italy from people who did it

For years now, people around the world have been captivated by Sicilian towns selling off abandoned homes starting at 1 euro, or roughly $1.08. Several hundred homes have been sold to curious and ambitious renovators, including Meredith Tabbone, 44, of Chicago. She learned in 2019 that a town called Sambuca di Sicilia was auctioning off homes starting with 1-euro bids. “A lot of people warned me that it could be a scam [and that] I could end up losing a lot of money,” she tells CNBC Make It. Still, she took up the idea when she realized her great-grandfather was...